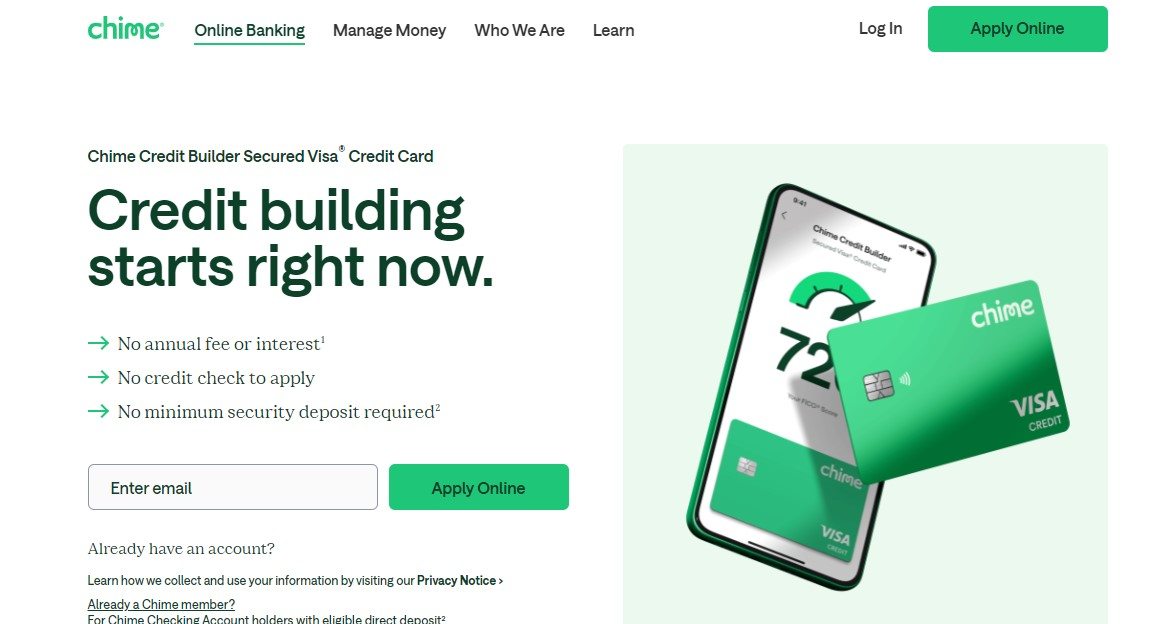

Chime Credit Builder Visa: An Effective Tool for Credit Rebuilding

Rebuilding credit is a journey that many people face after financial difficulties, and the Chime Credit Builder Visa has stood out as an effective and accessible solution. With the flexibility and benefits offered by this secured card, low- and middle-income consumers can rebuild their credit history without the exorbitant costs and limitations of traditional credit cards. In this article, we will explore the key aspects of the Chime Credit Builder Visa, its benefits, how it works, and how it can sustainably help improve credit.

What is the Chime Credit Builder Visa?

The Chime Credit Builder Visa® is a secured credit card issued by Chime, a fintech company that has revolutionized the financial market with fee-free services and innovative banking solutions. The key feature of this card is that it does not require a credit check during the application process, making it accessible to those with poor or limited credit history. Additionally, it charges no interest or fees, eliminating one of the main pitfalls of conventional credit cards.

How Does the Card Work?

To obtain the Chime Credit Builder Visa, the user must first open a Chime account and make a deposit of at least $200. This amount acts as collateral for the credit offered, similar to a traditional secured credit card. However, unlike traditional cards that may charge maintenance fees or high interest, Chime differentiates itself by not charging these fees, making it much more accessible for people rebuilding their credit.

Once approved, users can use the card anywhere Visa is accepted, offering great flexibility. Each purchase made with the card is reported to the major credit bureaus (Experian, Equifax, and TransUnion), allowing users to build a positive credit history by making regular payments.

Benefits of the Chime Credit Builder Visa

The Chime Credit Builder offers several benefits that make it attractive to consumers looking to improve their credit in a safe and efficient way.

- No Fees and No Interest Unlike many secured credit cards that charge an annual fee or balance fees, the Chime Credit Builder does not charge any fees. Moreover, there is no interest as long as you keep the card balance within the amount you have loaded into the account, eliminating the risk of incurring further debt with card usage(CardRates.com).

- Improves Credit History All card activities are reported to the major credit bureaus, meaning that you can improve your credit score over time as long as you use the card responsibly. Timely bill payments and moderate credit use are crucial factors in boosting your credit score.(CardRates.com)(Electronic Payments Coalition).

- Credit Flexibility Unlike other cards, the credit limit of the Chime Credit Builder Visa is not fixed. The user has the flexibility to adjust the limit based on the amount deposited into the account linked to the card, providing greater control over credit use and avoiding overspending(CardRates.com).

- Easy Access There is no credit check required during the card application, making it accessible to a large number of consumers who would otherwise face difficulties getting approved for traditional credit cards. This is especially useful for those with limited or poor credit. (Electronic Payments Coalition).

- Safe Credit Building Another highlight of the Chime Credit Builder is that it offers a safe way to build credit. Since the card is tied to a deposit made by the user, there is no risk of overspending, as the amount spent never exceeds the loaded balance. This allows users to have a more controlled and secure experience in dealing with credit(CreditCards.com).

How to Use the Chime Credit Builder Efficiently

While the Chime Credit Builder is a powerful tool for credit rebuilding, using it efficiently requires a few fundamental practices to maximize its benefits.

- Timely Payments The most important factor in building credit is ensuring that payments are made on time. The Chime Credit Builder makes this easier by not allowing you to spend more than you have in the account, but it’s crucial that payments are made in full each month.

- Moderate Credit Use Even with the flexibility offered by the card, it’s recommended to keep credit utilization at a moderate level. Ideally, you should use less than 30% of your credit limit, as this is viewed positively by credit bureaus and can help boost your score more quickly.

- Credit Monitoring Chime also offers credit monitoring tools that can be helpful in tracking progress over time. This allows users to see how their actions are impacting their credit score and adjust their habits as necessary(CreditCards.com)

The Chime Credit Builder Visa is an excellent option for anyone looking for an affordable and secure way to rebuild their credit. With no fees or interest, and ease of use, it offers a clear path to improving credit history without the traditional pitfalls of other cards. When used responsibly, the Chime Credit Builder Visa® can be an important step towards achieving a healthier and more stable financial life.

This card not only helps with credit building but also provides a practical solution for controlling spending, making it a valuable resource for low- and middle-income consumers in the United States.

Deixe um comentário